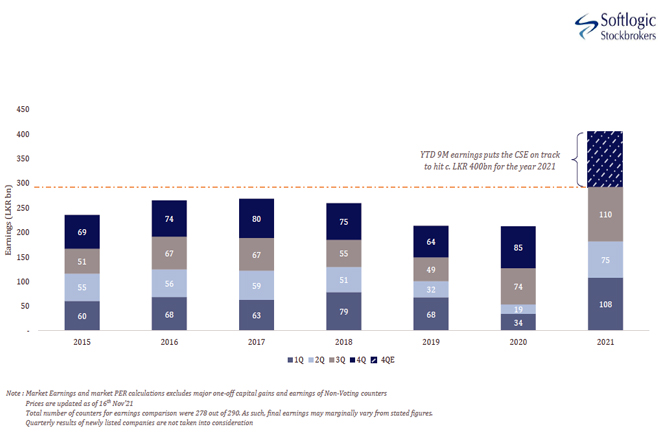

Corporate earnings recorded a phenomenal increase up +98% YoY from LKR 190bn to LKR 377bn on a Trailing 12 months (TTM) basis despite the impact of the 2nd, 3rd and 4th wave of covid-19 during the reporting period, Softlogic Stockbrokers said.

Releasing the Corporate Earnings Snapshot, Softlogic Research said that 3Q 2021 earnings have improved 48% from LKR 75bn to LKR 110bn.

In just 9 months, corporate earnings have far surpassed full year historical earnings in the CSE, to record a staggering LKR 292bn, with the December quarter (historically being the best quarter) still to come.

The growth, however, comes on the back of revenge spending, pent-up demand cycles, protectionist policies, import restrictions, loan moratoriums, and expansionary monetary policies driving down interest rates, vis à vis lower financing costs.

Sector Earnings

The banking sector earnings shot up 48% YoY on the back of deposit repricing at lower interest rates, a rise in fee and commission income and lower impairments as the economic recovery got into gear. Prudent impairment provisioning was seen during the quarter, whilst a healthy growth of the loan book continued.

The sector earnings grew by almost LKR 50bn on a YoY basis, led by growth in HAYL, JKH, VONE, and the tile industry on the back of import protectionism, USD depreciation, and a revival in overall activity levels despite the delta impact.

Food Beverage Tobacco earnings grew marginally, growing at +3% YoY, whilst TTM growth stood at a stronger 84% as the sporadic lockdowns severely impacted the alcohol and tobacco industry which had almost 30 days of zero sales.

The materials sector earnings declined by (-36% YoY) whilst maintaining a growth of over 55% on a TTM basis amidst an economic recovery, whilst individual companies and industries faced external pressures on margins.

Health Care Equipment Services sector earnings improved significantly growing by +115% YoY during the quarter and 426% YoY on a TTM basis. It is a segment that may continue to thrive in the event of a long drawn recovery.

The telecommunication sector earnings grew by 24% YoY during the quarter and 37% on a TTM basis on the back of improved data consumption, longer call durations, cost-saving initiatives, and lower forex losses.

The transportation sector TTM earnings spiked a further 343% YoY, and 92% QoQ on the back of the extraordinary earnings of EXPO for the quarter.

The retailing sector faced a volatile period during the past 12 months due to the sporadic lockdowns and economic conditions which continued during this quarter owing to the delta variant However, an improvement may be due.

The Utilities Sector earnings grew 18% YoY due to the cyclical weather conditions whilst growing by 113% YoY on a TTM basis due to the sector's constant capacity additions.

Earnings-Review-3Q21