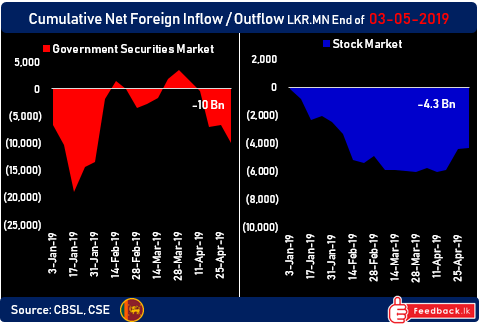

May 5, 2019 (LBO) - Money has started to flee Sri Lanka's bond markets in the aftermath of the devastating ISIS inspired Easter Sunday terrorist attacks. A net of close to US$20mn has exited from Sri Lanka's government bond market in the past week.

Before the attacks, Sri Lanka was starting to see more positive data with regard to foreign flows into capital markets. These inflows were beginning to reverse the damage caused by the recent 50 day constitutional crisis that the country was plunged into on October 26.

The constitutional crisis caused Sri Lanka's currency, the LKR, to hit an all time low at just over Rs183/US$. After the constitutional crisis was resolved, the currency started a slow climb back to levels approaching Rs172 to the dollar. Forecasts for the currency and foreign investment into bonds were positive.

After the terror attacks, the LKR has moved back down to Rs177 to the dollar. Forecasts have now turned negative with further LKR weakness expected in the short term. The Central Bank of Sri Lanka (CBSL) has acknowledged some level of intervention to keep the currency stable in the aftermath of the terrorist incidents.

The Sri Lankan economy has received two devastating blows from both the constitutional crisis as well as the Easter Sunday terror attacks.

buy nolvadex online

buy nolvadex online no prescription

This has been further exacerbated by the power crisis caused by low storage levels in the country's hydropower related reservoirs. The costs of these combined crises will almost certainly be in the billions of dollars for the Sri Lankan economy.

Despite all the recent hits to the Sri Lankan economy, the CBSL has been able to preserve a relative stability through a conservative and credible monetary policy. The CBSL is still holding to its 2019 growth forecast of 3.5%-4% for the Sri Lankan economy.