May 26, 2016 (LBO) – Sri Lanka’s Islamic Finance sector continues to grow steadily but lacks staff that are qualified and have technical knowledge, the recently launched Islamic Finance country report 2016 said.

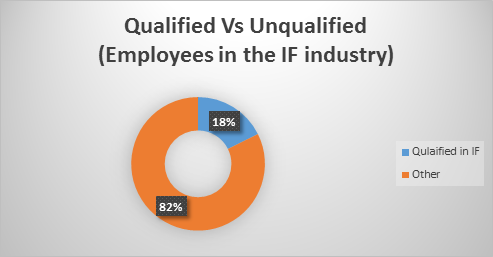

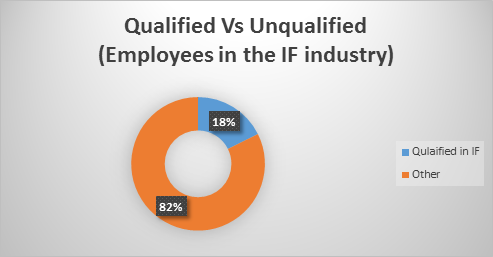

“Despite the growth in the number of players, not a great deal of progress has been made in terms of the numbers of qualified staff who are working in the industry,” says the Research Intelligence Units’s (RIU) report in association with GIH Capital.

“Currently, only 18 percent of all full-time employees have a formal Islamic Finance qualification as compared with 13.4 percent in 2012.”

According to the findings of this study, there are approximately 1,484 persons directly employed in the industry which represents an increase of some 58 percent in terms of absolute numbers of workers.

RIU says not a great deal of progress has been made in terms of the numbers of qualified staff who are working in the industry.

'In absolute numbers, this represents only some 152 additional qualified staff entering the labor market over the past four years."

However, deeper analysis of the labor market reveals complex dynamics that involve outward migration of qualified labor, a significant phenomenon in Sri Lanka, especially to the Middle East as well as some inward migration of qualified students returning to the island.

Therefore, the report says when all these multifarious dynamics are factored in, it may be safe to conclude that the education service providers are contributing to the supply of more qualified staff at the middle levels in to the industry although the data indicates that a lot more effort is needed in this regard.

"At the higher levels of the organizations, our research indicates that hands-on experience is often valued much higher than formal qualifications," it said.

"This too is understandable, given the comparatively nascent stage of the industry in Sri Lanka and the shortage of professional who have a strong track record of achievement."

Consequently, those with hands-on experience are highly sought after in the market.

According to the report the Islamic Finance industry has grown globally at an annual rate of 10-12 percent over the past 10 years with Shariah compliant financial assets estimated at approximately 2 trillion US dollars in 2015.

“The interest in Islamic Finance among non-Muslim countries such as the UK, Luxembourg, South Africa and Hong Kong, have been quite progressive,” it said.

“Similarly, the local industry has seen significant growth over the last few years.”

Since the amendment to the Banking Act in 2005 (Act No. 2 of 2005), more than a dozen banks and financial institutions now offer Shariah compliant products.

“There are several large professional service firms that have specialist Islamic Finance teams.’

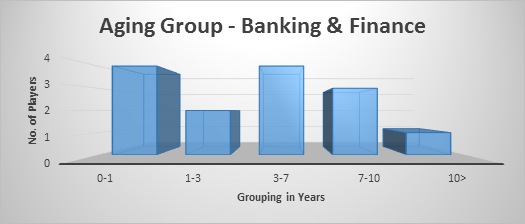

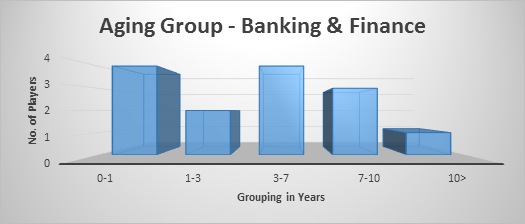

The banking and finance industry still continues to dominate the landscape in terms of the number of players while there have also been new entrants into the Islamic Insurance and Microfinance space.

Microfinance, especially the report says is growing as it upholds many of the principles advocated in traditional Islamic Finance such as equal opportunity, advocacy of entrepreneurship, risk sharing, disbursement of collateral free loans, and participation of the poor.

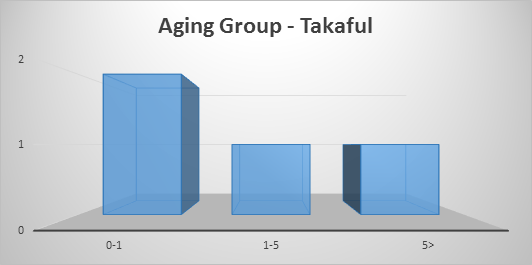

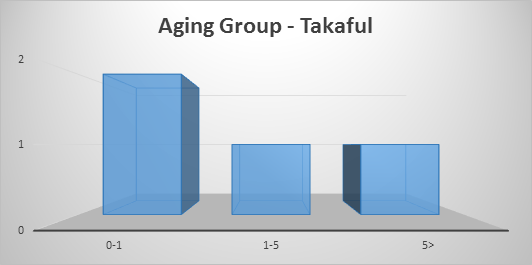

It is worth noting that we have witnessed the entry of more Takaful operators in recent years whilst some of the smaller consulting firms together with subsidiary entities that have been part of a larger Holding companies have sized operations.

"Interestingly, we find that the total number of players in the industry in 2012 and 2016 remains the same at 37 while for the most part, the same operators who were in business four years ago are still in today’s’ market," RIU says.

"Those few who have exited from the industry have been replaced by new entrants in the same exact number.'

However, deeper analysis of the labor market reveals complex dynamics that involve outward migration of qualified labor, a significant phenomenon in Sri Lanka, especially to the Middle East as well as some inward migration of qualified students returning to the island.

Therefore, the report says when all these multifarious dynamics are factored in, it may be safe to conclude that the education service providers are contributing to the supply of more qualified staff at the middle levels in to the industry although the data indicates that a lot more effort is needed in this regard.

"At the higher levels of the organizations, our research indicates that hands-on experience is often valued much higher than formal qualifications," it said.

"This too is understandable, given the comparatively nascent stage of the industry in Sri Lanka and the shortage of professional who have a strong track record of achievement."

Consequently, those with hands-on experience are highly sought after in the market.

According to the report the Islamic Finance industry has grown globally at an annual rate of 10-12 percent over the past 10 years with Shariah compliant financial assets estimated at approximately 2 trillion US dollars in 2015.

“The interest in Islamic Finance among non-Muslim countries such as the UK, Luxembourg, South Africa and Hong Kong, have been quite progressive,” it said.

“Similarly, the local industry has seen significant growth over the last few years.”

Since the amendment to the Banking Act in 2005 (Act No. 2 of 2005), more than a dozen banks and financial institutions now offer Shariah compliant products.

“There are several large professional service firms that have specialist Islamic Finance teams.’

The banking and finance industry still continues to dominate the landscape in terms of the number of players while there have also been new entrants into the Islamic Insurance and Microfinance space.

Microfinance, especially the report says is growing as it upholds many of the principles advocated in traditional Islamic Finance such as equal opportunity, advocacy of entrepreneurship, risk sharing, disbursement of collateral free loans, and participation of the poor.

It is worth noting that we have witnessed the entry of more Takaful operators in recent years whilst some of the smaller consulting firms together with subsidiary entities that have been part of a larger Holding companies have sized operations.

"Interestingly, we find that the total number of players in the industry in 2012 and 2016 remains the same at 37 while for the most part, the same operators who were in business four years ago are still in today’s’ market," RIU says.

"Those few who have exited from the industry have been replaced by new entrants in the same exact number.'

However, deeper analysis of the labor market reveals complex dynamics that involve outward migration of qualified labor, a significant phenomenon in Sri Lanka, especially to the Middle East as well as some inward migration of qualified students returning to the island.

Therefore, the report says when all these multifarious dynamics are factored in, it may be safe to conclude that the education service providers are contributing to the supply of more qualified staff at the middle levels in to the industry although the data indicates that a lot more effort is needed in this regard.

"At the higher levels of the organizations, our research indicates that hands-on experience is often valued much higher than formal qualifications," it said.

"This too is understandable, given the comparatively nascent stage of the industry in Sri Lanka and the shortage of professional who have a strong track record of achievement."

Consequently, those with hands-on experience are highly sought after in the market.

According to the report the Islamic Finance industry has grown globally at an annual rate of 10-12 percent over the past 10 years with Shariah compliant financial assets estimated at approximately 2 trillion US dollars in 2015.

“The interest in Islamic Finance among non-Muslim countries such as the UK, Luxembourg, South Africa and Hong Kong, have been quite progressive,” it said.

“Similarly, the local industry has seen significant growth over the last few years.”

Since the amendment to the Banking Act in 2005 (Act No. 2 of 2005), more than a dozen banks and financial institutions now offer Shariah compliant products.

“There are several large professional service firms that have specialist Islamic Finance teams.’

The banking and finance industry still continues to dominate the landscape in terms of the number of players while there have also been new entrants into the Islamic Insurance and Microfinance space.

Microfinance, especially the report says is growing as it upholds many of the principles advocated in traditional Islamic Finance such as equal opportunity, advocacy of entrepreneurship, risk sharing, disbursement of collateral free loans, and participation of the poor.

It is worth noting that we have witnessed the entry of more Takaful operators in recent years whilst some of the smaller consulting firms together with subsidiary entities that have been part of a larger Holding companies have sized operations.

"Interestingly, we find that the total number of players in the industry in 2012 and 2016 remains the same at 37 while for the most part, the same operators who were in business four years ago are still in today’s’ market," RIU says.

"Those few who have exited from the industry have been replaced by new entrants in the same exact number.'