buy priligy online priligy online generic

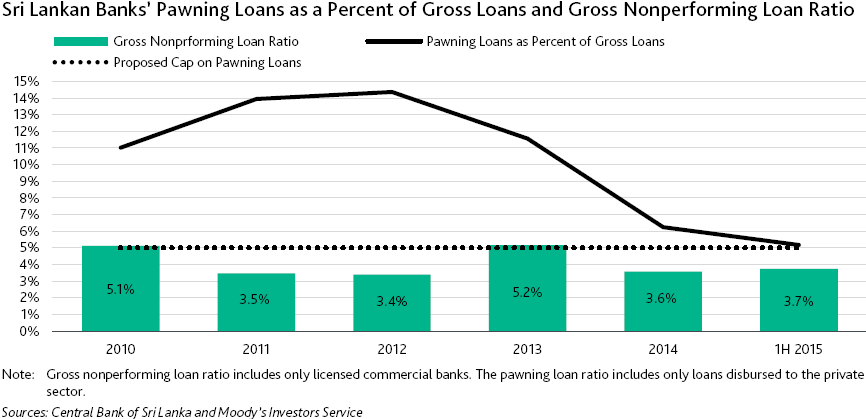

Two of our rated entities, Bank of Ceylon (BOC, B2/B1 stable, b1) and Hatton National Bank Ltd. (HNB, B2 stable, b1), are among the banks that will benefit from these tighter rules. Mr. Karunanayake proposed limiting pawning loans to 5% of a bank’s loan book. The quality of these loans is directly linked to volatile gold prices, which makes them risky for banks.

online pharmacy buy diflucan with best prices today in the USA

buy synthroid online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/synthroid.html no prescription pharmacy

As Exhibit 1 shows, problem loans for Sri Lanka’s commercial banks increased materially in 2013 following a 27% decrease in gold prices that year. The asset quality of Sri Lankan banks has stabilized as banks shrank their pawning loan books to 5.

buy doxycycline online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/doxycycline.html no prescription pharmacy

2% of gross loans as of the end of June 2015, from 14.

buy suhagra online suhagra online generic

4% at the end of 2012. The proposed 5% cap will further decrease banks’ exposure to these loans and will prevent excessive growth in this segment if gold prices increase.

buy estrace online https://www.cappskids.org/wp-content/uploads/2022/08/png/estrace.html no prescription pharmacy

The second proposal mandates that banks cease consumer finance lending starting 1 June 2016. Such loans are provided to individuals and are typically higher risk and unsecured.

The second proposal mandates that banks cease consumer finance lending starting 1 June 2016. Such loans are provided to individuals and are typically higher risk and unsecured. online pharmacy buy spiriva inhaler with best prices today in the USA

buy xifaxan online https://www.cappskids.org/wp-content/uploads/2022/08/png/xifaxan.html no prescription pharmacy

As of the end of June 2015, consumer finance loans composed around 5% of gross loans for the five largest banks engaged in consumer lending.

buy symbicort inhaler online https://www.cappskids.org/wp-content/uploads/2022/08/png/symbicort-inhaler.html no prescription pharmacy

For those banks, the growth in this segment has been rapid, averaging a compounded annual growth rate of 44% over the past four years, compared with 24% growth in gross loans excluding consumer finance.

buy amoxil online amoxil online generic

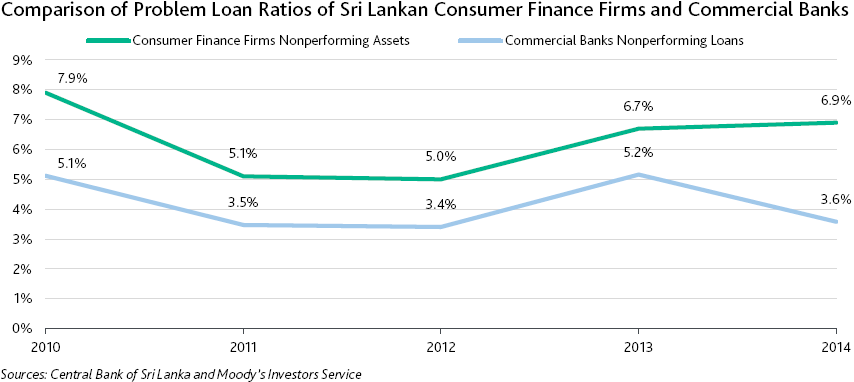

Consumer finance lending has historically had poor asset quality relative to secured banking loans, reflected by the weaker asset quality of specialized Sri Lankan consumer finance firms. As shown in Exhibit 2, consumer finance firms had a 6.9% problem-loan ratio at the end of 2014, versus 3.

online pharmacy buy abilify with best prices today in the USA

buy levofloxacin online https://www.indcheminternational.com/wp-content/uploads/2022/08/png/levofloxacin.html no prescription pharmacy

6% for the commercial banks.

We expect that the Central Bank of Sri Lanka will likely implement the proposed limitations on pawning and consumer finance loans because the authorities want to limit the banks’ exposures to risky sectors, while simultaneously promoting credit growth to other sectors of the economy, such as agriculture, small and midsize enterprises, the young and women.

We expect that the Central Bank of Sri Lanka will likely implement the proposed limitations on pawning and consumer finance loans because the authorities want to limit the banks’ exposures to risky sectors, while simultaneously promoting credit growth to other sectors of the economy, such as agriculture, small and midsize enterprises, the young and women.