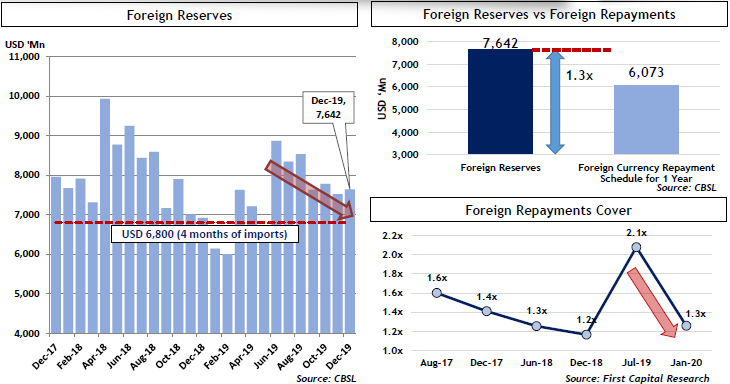

Feb 19, 2020 (LBO) – First Capital Research expects Sri Lanka's foreign reserves to fall to around 7 billion US dollars by June this year due to the debt repayments despite the 1 billion dollar Chinese Loan.

Launching the Strategy Report 2020, Head of Research at the First Capital Holdings, Dimantha Mathew emphasized that a large foreign loan or sovereign bond needs to be raised in order to maintain reserves above the 7 billion dollar mark.

"We believe foreign reserves, though currently remains at comfortable levels above the minimum 4 months of imports, foreign repayments start to slowly accelerate especially in the 2H2020," he said.

"Thereby, it becomes critical for the Govt. to refinance foreign loans of around 6 billion dollars to maintain reserves at the current level."

Since the successful sovereign bond issuance in Jun 2019, foreign reserves have slowly depleted, but over the last 3-4 months, the Central Bank has managed to maintain it around the 7.5 billion dollar mark.

Sri Lanka's government has announced plans to raise 1 billion US dollars via a Chinese Loan.

Dimantha expected that the overall bond repayments to dip in 2020, but foreign debt repayments to remain high in the second and third quarters of this year.

"2020 illustrates a notable reduction in repayments especially in 1Q2020 and 4Q2020. However, we expect foreign payments in the range of USD 300-350Mn to exist on a monthly basis in the form of project loan repayments while 2Q & 3Q illustrates relatively high repayments," he said.

"We expect Debt to GDP to rise to 85% in 2019 while we expect it to marginally dip to 84% in 2020 partly with the acceleration of GDP growth, comparatively lower debt repayments and possible large FDIs led by the Port City."