The APAC chapter of the Public Relations and Communications Association (PRCA), the world’s largest and influential PR body, carried out a survey during October with the view of understanding and informing on the state of the PR industry in Sri Lanka. The survey was carried out among 33 leaders and senior executives from over local and multinational PR agencies.

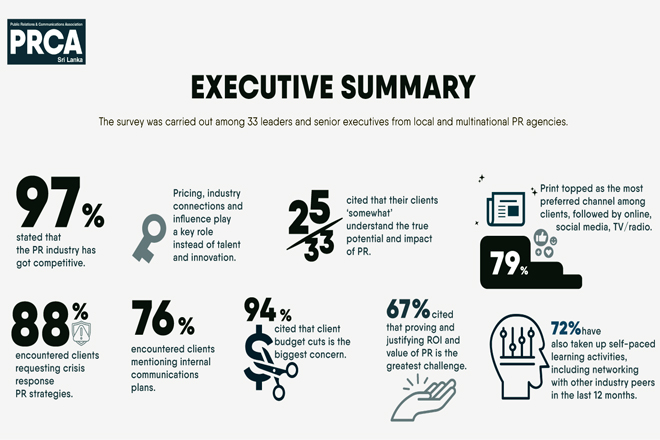

97pct of the respondents stated that the PR industry has got competitive over the recent years, with pricing, industry connections and influence playing a key role instead of talent and innovation. 25 out of 33 professionals cited that their clients ‘somewhat’ understand the true potential and impact of PR, and that the pandemic and recent economic events have pushed companies to manage their reputation proactively.

‘The findings give a hint that despite being a niche industry, the PR profession and landscape in the country is poised for exponential growth given that some of the diverse challenges and suggestions are addressed timely. We at PRCA APAC will actively be involved in uplifting the standards together with the agencies and other stakeholders,’ said country representative Thanzyl Thajudeen MPRCA, who curated and led the initiative.

Print topped as the most preferred channel among clients (79pct), followed by online, social media, TV/radio, and others. However, 42pct mentioned their clients citing print PR as not effective at some point with 33pct strongly advocating that print is very much here. When it comes to which channels their agencies promote, online surpassed print slightly by 12pct.

Most of the clients were seen engaging with on-going PR activities, followed by reputation building, brand positioning, crisis response and mitigation, and internal communications. 88pct of those surveyed have been involved or encountered clients requesting crisis response PR strategies with 76pct mentioning internal communications plans.

The challenges their clients were facing include budget cuts (91pct), exchange rates (64pct), import ban (55pct), and retaining talent and finding customers (50pct). Agencies cited client budget cuts (94pct) as the biggest concern faced with the present volatile situation, followed by convincing clients the crucial role PR could play, payment delays, and employee turnover.

However, 67pct cited that proving and justifying ROI and value of PR is the greatest challenge with the need to have more measures, tools and insights in place.

Despite the many challenges and half of the respondents feeling a burnout in their role, the PR industry is very optimistic. 79pct stated that there are many new areas to learn within the discipline, citing that PR is becoming more social than digital and that it also requires an approach backed by analytics, accountability and ethics.

This was well reflected when asked as to why they work where they work. Learning (79pct) superseded all other factors such as agency reputation, networking, compensation, networking, job mobility, and workplace environment. 72pct have also taken up self-paced learning activities recently, including networking with other industry peers in the last 12 months.

The PR professionals cited that the industry needs to work more towards knowledge sharing, collaborations and partnerships, and talent and capacity building (73pct), with nearly half of them suggesting the need to uplift its ethical standards.

Many voiced the need to address and change the misconceptions among clients and society at large of what PR really is, going way beyond the traditional ‘media release’ sense, and that a solid educational or vocational framework is required to help aspiring students and professionals alike to comprehend and understand this lucrative profession in its right essence including ongoing knowledge transfer and training sessions among all agencies involved in the broader spectrum of communications.