“We remain optimistic about the commercial sector real estate space,” said JLL, Lanka, managing director Steven Mayes.

“However, we are advising our clients to remain cautious about retail and residential markets, both of which face challenges going forward.”

The commercial sector continues to gather pace buoyed by strong demand, especially in the international grade A space which is currently under supplied in Colombo 1, 2 and 3.

“We remain optimistic about the commercial sector real estate space,” said JLL, Lanka, managing director Steven Mayes.

“However, we are advising our clients to remain cautious about retail and residential markets, both of which face challenges going forward.”

The commercial sector continues to gather pace buoyed by strong demand, especially in the international grade A space which is currently under supplied in Colombo 1, 2 and 3.

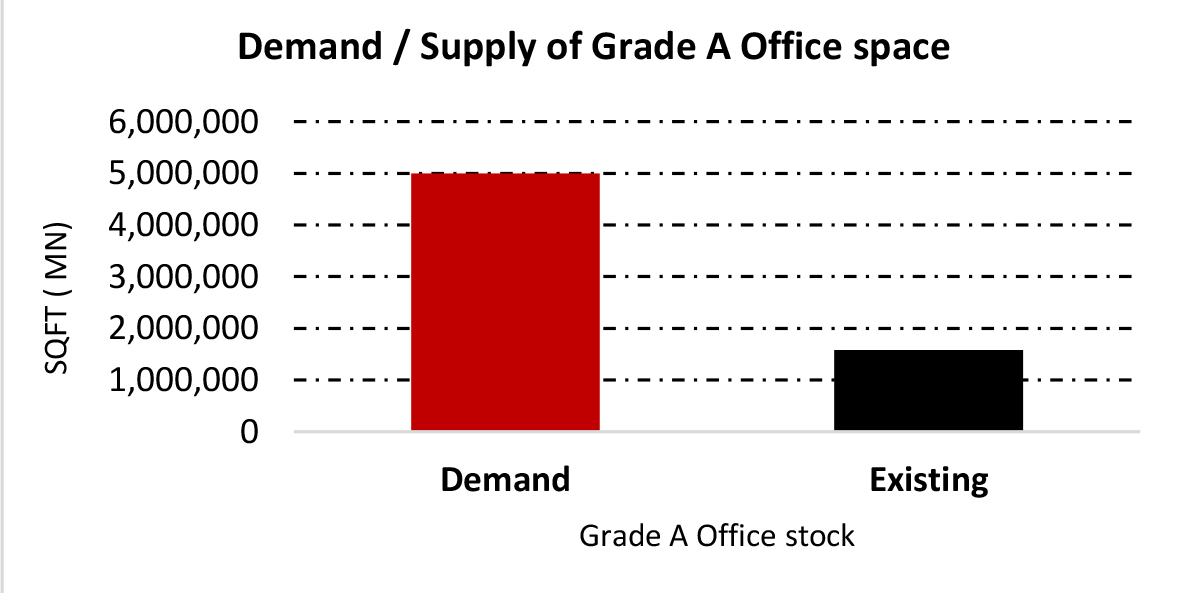

The existing stock of office space in the grade ‘A’ sector in Colombo is just over 1.5 million square feet.

When considered in the context of anticipated total demand for Grade ‘A’ in 2018, at around 5 million square feet, it is very apparent that there is a shortage of about 200 percent in supply.

Absorption of most Grade ‘B’ spaces have also seen an uptick, as occupiers run out of Grade A options and are forced to compromise with alternatives.

While an uptick in demand is expected for spaces in Colombo from IT and related sectors stemming from 2018 budget provisions for the sector, it would be prudent to note that IT companies typically prefer out of town locations and lower cost options to fit with their business model.

The newly signed Free Trade Agreements with India and Singapore are also positives for the economy and the maintenance of robust demand for commercial office space.

Infrastructure development focused on connectivity between Colombo and Kandy could potentially increase tourism activity, further infrastructure developments, logistics activity, and generate more general business, which will bring in more demand for office space in both cities.

Prospects for the retail sector look encouraging over 2018/19, but beyond this lies potential excess supply issues. While the ongoing mall developments will experience the ‘first-mover’ advantage, those that follow may experience demand related issues due to a lack of brands to occupy space.

The longer-term success of this sector is heavily dependent upon government policy, especially with import tariff rates and infrastructure spending, on roads and public transport, as traffic congestion is a major impediment to retail growth.

In current retail outlets demand for space still outstrips supply, but the gap will narrow after 2019, with other malls coming on stream in central and secondary business districts and residential zones.

The existing stock of office space in the grade ‘A’ sector in Colombo is just over 1.5 million square feet.

When considered in the context of anticipated total demand for Grade ‘A’ in 2018, at around 5 million square feet, it is very apparent that there is a shortage of about 200 percent in supply.

Absorption of most Grade ‘B’ spaces have also seen an uptick, as occupiers run out of Grade A options and are forced to compromise with alternatives.

While an uptick in demand is expected for spaces in Colombo from IT and related sectors stemming from 2018 budget provisions for the sector, it would be prudent to note that IT companies typically prefer out of town locations and lower cost options to fit with their business model.

The newly signed Free Trade Agreements with India and Singapore are also positives for the economy and the maintenance of robust demand for commercial office space.

Infrastructure development focused on connectivity between Colombo and Kandy could potentially increase tourism activity, further infrastructure developments, logistics activity, and generate more general business, which will bring in more demand for office space in both cities.

Prospects for the retail sector look encouraging over 2018/19, but beyond this lies potential excess supply issues. While the ongoing mall developments will experience the ‘first-mover’ advantage, those that follow may experience demand related issues due to a lack of brands to occupy space.

The longer-term success of this sector is heavily dependent upon government policy, especially with import tariff rates and infrastructure spending, on roads and public transport, as traffic congestion is a major impediment to retail growth.

In current retail outlets demand for space still outstrips supply, but the gap will narrow after 2019, with other malls coming on stream in central and secondary business districts and residential zones.buy singulair online buy singulair online no prescription