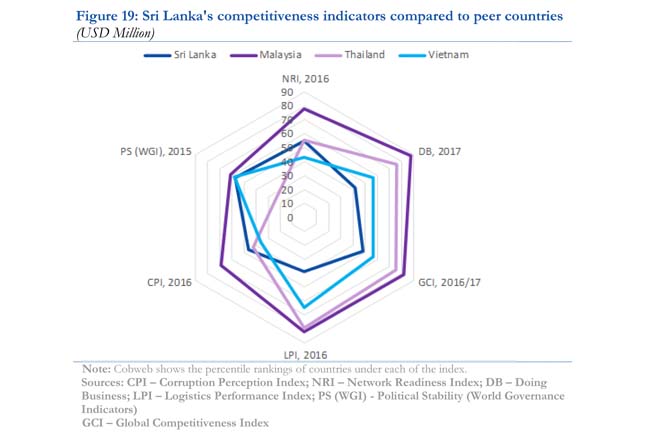

At the same time, the report says the investment climate, which is lagging behind those of its peers, pose obstacles for new firms to be created and for existing ones to grow and compete.

The decline in openness and stagnating FDI took place when the rest of the world was integrating more strongly, thus resulting in a decline in Sri Lanka’s world market share to the levels last seen in the 1980s.

At the same time, the report says the investment climate, which is lagging behind those of its peers, pose obstacles for new firms to be created and for existing ones to grow and compete.

The decline in openness and stagnating FDI took place when the rest of the world was integrating more strongly, thus resulting in a decline in Sri Lanka’s world market share to the levels last seen in the 1980s.buy augmentin online buy augmentin online no prescription

The introduction of para-tariffs during the last decade has effectively doubled the protection rates (from an average Most Favored Nation, MFN, tariff rate of 13 percent to average total nominal protection rate above 28 percent), making the present import regime one of the most complex and protectionist in the world, the report adds. According to the update, Sri Lanka’s structurally low tax-to-GDP ratio and its heavy reliance on trade taxes (on average 40 percent from import related taxes and 13 percent from protective taxes in the total tax revenue) complicates trade reform. However, it says if Sri Lanka’s trade-to-GDP ratio increased back to what it was in 2000 (89 percent) or even more to 160 percent (as in the case of Vietnam), even low tariffs could yield significant import revenues. "Thus, the new trade policy, while being mindful of the impact of tariff reform on fiscal revenue and balance of payments, needs to incorporate a gradual but firm liberalization schedule, allowing time for adjustment, with a fixed phase-out schedule." "It is clear that para-tariffs need to be consolidated, reduced in magnitude, and eventually eliminated, as they are non-transparent in nature and their ad-hoc imposition as an easy “go-to” for revenue generation takes away predictability, which is critical for production and investment decisions." In order to benefit from an export-led growth model, the reprort says which is necessarily based on trade, it is important that Sri Lanka strengthens its competitiveness in order to promote trade and FDI, leverage its local advantage of geographical proximity to the powerhouses, establish the necessary conditions for a thriving knowledge economy, integrate productive local companies in global value chains, and attain higher value addition in the manufacturing sector. "This reform process will be key for Sri Lanka’s sustained economic prosperity."