buy zenegra online https://www.oriondentalcare.com/wp-content/themes/oriondental/inc/php/zenegra.html no prescription

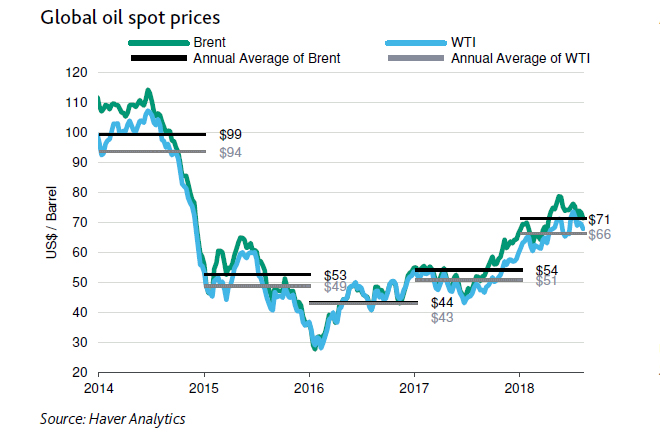

” Eventually, higher drilling and services costs could push fundamental prices closer to the top end of 45-65 dollars per barrel range. In the near term, however, Moody’s said a number of factors that have led the Brent spot price to move above 70 dollars per barrel (with the WTI at $3-$5 below Brent) will continue to support elevated oil prices. Geopolitical risk and inconsistent production in countries like Libya and Nigeria, along with declining production in Venezuela, have added upward pressure on the price of oil, more than offsetting the downward pressure from a stronger US dollar. According to Moody’s, other transitory events also play a part, such as the recent shutdown of the Syncrude facility in Canada or the strike by Norwegian oil workers. “These drivers are likely to be short-lived, but will contribute to volatility in the oil market,” Moody’s said. “The reimposition of US sanctions on Iran also adds a fair degree of uncertainty.” Oil spot prices are inherently volatile. Robust global growth is ensuring adequate demand.

buy nolvadex online https://www.oriondentalcare.com/wp-content/themes/oriondental/inc/php/nolvadex.html no prescription

Numerous technical factors affect oil spot prices both positively and negatively.