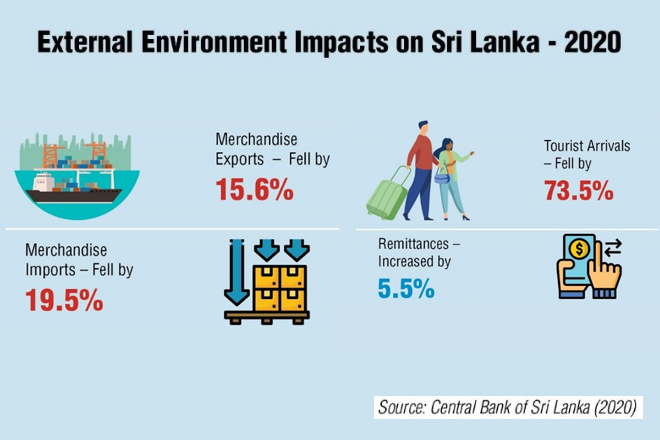

Global economic developments have impacted Sri Lanka’s external sector performance, and the economy overall. While Sri Lanka managed the first wave of the COVID-19 outbreak imposing lockdown measures for two months (March to May 2020), it has since been hit by a second outbreak since October 2020 and a third wave in April 2021. The latter is leading to a substantial increase in active cases of COVID-19, along with higher numbers of deaths, disrupting the gradual economic recovery witnessed from the second quarter of 2020. Merchandise exports, tourism earnings, and foreign direct investment (FDI) inflows are all bearing the brunt of the resultant fallout, except for remittance inflows into the country.

Merchandise Trade

Along with the considerable disruptions to world trade, Sri Lanka’s merchandise trade flows also proved to be fairly volatile, with the overall result being weakened exports and imports during the pandemic. Even prior to the pandemic, Sri Lanka’s long-term export growth rate was on a declining trend, albeit with some improvements in the immediate pre-COVID-19 years. In 2020, the pandemic amplified this long-term decline. Merchandise exports contracted by -15.6% in 2020 compared to the previous year, reflecting both demand and supply shocks.

Overall, as Sri Lanka’s export sector strategies and policies are not firmly integrated into regional and global value chains (GVCs), the impact of supply chain disruptions to the country's export sector has not been very prominent. However, the country has been facing several adverse issues related to declining demand in its major export markets. Sri Lankan exports traditionally target product markets in a few destinations such as the US, UK and some EU countries. Its export basket too remains rather limited, with overwhelming dependence still on T&G and a few agricultural products. The need to revive export performance with sound strategies will take on even more urgency in the wake of the pandemic to build greater resilience.

As countries adjust to the economic fallout of the pandemic, existing global supply chains will change. Sri Lanka too must be prepared to change direction in favour of strengthening regional linkages. The Asian region is expected to recover swiftly, led by China’s resurgent economy. Whilst India is struggling to bring its latest COVID-19 spread under control, the Indian economy too can be expected to record a strong bounce back eventually. Against these developments, Sri Lanka must exploit potential integration opportunities with the Asian region, to better connect to trade, technology and FDI flows.

Compared to exports, Sri Lanka’s import expenditures fell even more sharply in 2020, contracting by as much as -19.5%. A part of the decline was no doubt a reflection of weakened private investment, declining oil prices and subdued consumer demand. However, a large quantum of the drop in import expenditures is due to restrictions imposed on ‘non-essential’ merchandise imports such as motor vehicles, as well as restrictions on import substitute sectors such as agriculture and processed agricultural food products.

Sri Lanka’s fuel import bill accounts for the country's largest import category. The expenditure on fuel contracted by -34.7% in 2020 compared to 2019.[1] Weakened oil prices in the global market and the sharp decline in domestic demand supported this contraction. While the oil price war between Organization of the Petroleum Exporting Countries (OPEC) and Russia, and declining global oil demand created this decline in prices, a continuation of these advantages cannot be expected as global demand picks up and oil producing countries agree to curb oil supplies.

Tourism and Remittances

In the aftermath of the Easter Sunday attacks in April 2019, Sri Lanka’s post-war tourism sector recovery came to an abrupt halt. In response, several strategies were implemented, including financial assistance to the sector as well as promotional campaigns to secure visitors. The mobility and physical containment measures imposed with the onset of COVID-19 dealt a further blow to the Sri Lankan tourism industry. With the suspension of tourist arrivals from all countries with effect from mid-March 2020, tourist arrivals came to a complete halt more or less for nine months (April to December 2020). International arrivals to the Sri Lankan border saw a sharp decline of -73.5% in 2020.

By contrast, Sri Lanka’s worker remittance inflows have performed much better than what had been forecast. Remittances had been experiencing a consistent decline over the past few years, reflecting external and internal developments related to foreign employment. In 2020, after an initial brief drop, remittances grew by 5.5% to USD 7.1 billion. The increase is perhaps explained by Sri Lankan migrants who may be remitting larger amounts as coping mechanisms for their households, as well as those remitting funds in preparation for returning to Sri Lanka owing to loss of employment in host economies. Additionally, the pandemic conditions, including limited mobility and greater uncertainty may have encouraged the diversion of remittances from informal to formal channels.[2]

Capital Flows: FDI and Capital Market Trends

Even though Sri Lanka is argued to have a strategic geographical advantage straddling major shipping routes in the Indian Ocean, the country has not yet been able to convert this to substantive progress in attracting FDI inflows. FDI inflows saw some improvement in the post-war period and reached a peak in 2018 but has been on a declining trend thereafter. The pandemic has amplified this shrinkage.Retaining investor confidence through sound policy decisions, ensuring domestic security measures, and providing a transparent and accountable regulatory environment are vital to attract more FDI to the country.

The government is attempting to facilitate foreign investments into favourable locations in the country such as the Hambantota industrial zone, the Colombo Port City, as well as easing regulatory constraints to address time taken to set up a business in Sri Lanka, etc. The priority in these efforts appears to hinge on the Colombo Port City which will be granted special tax dispensations and other inducements to kick-start FDI inflows into mixed development projects and other infrastructure dominant sectors. The urgency to attract more FDI is partly related to the governments stated policy intention to move away from debt creating capital inflows to non-debt creating sources such as FDI. In the context in which Sri Lanka is struggling to access international capital markets in a COVID-19 environment, an enhanced inflow of FDI will provide relief on the external front.

Looking Ahead

For a country with a small domestic consumer base, Sri Lanka must remain competitive in international markets as a source of goods and services. Calibrating trade policies to integrate into re-fashioned GVCs, especially in a regional context, should remain an important part of the country’s medium-term recovery efforts towards a stable external sector environment that will support the country’s long-term growth and development aspirations.

* This Policy Insight is based on the comprehensive chapter on “COVID-19, Global Economic Developments and Impact on Sri Lanka” in the ‘Sri Lanka: State of the Economy 2020’ report – the annual flagship publication of the Institute of Policy Studies of Sri Lanka (IPS).

[1] Central Bank of Sri Lanka. (2021, January). External Sector Performance. Colombo: Central Bank of Sri Lanka.

[2] Weeraratne, Bilesha. (2021, January 28). How Sri Lankan Remittances are Defying COVID-19. Retrieved April 8, 2021, from East Asia Forum: https://www.eastasiaforum.org/2021/01/28/how-sri-lankan-remittances-are-defying-covid-19/