May 24, 2019 (LBO) - Harry Jayawardena, perhaps Sri Lanka's wealthiest man, now controls close to 10% of the outstanding shares in Sri Lanka's most important company.

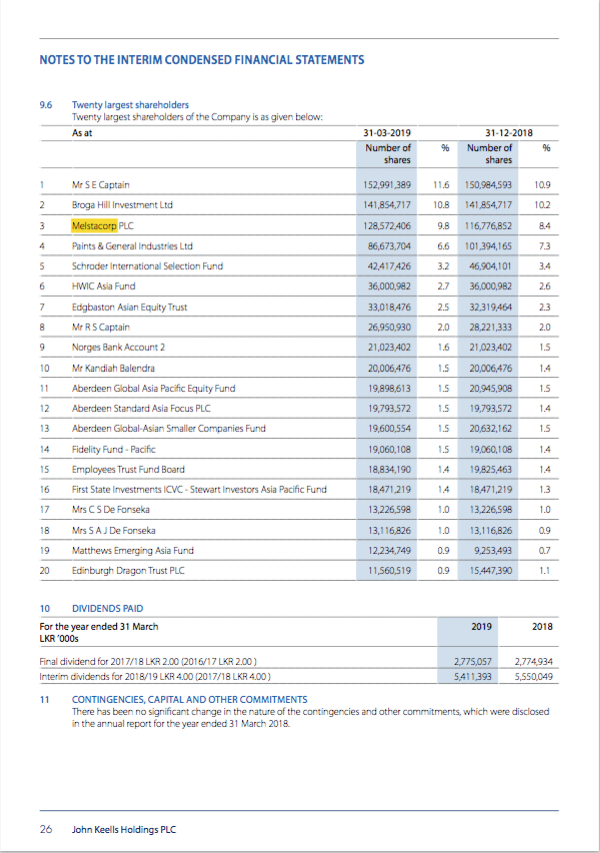

The latest published shareholder list of John Keells Holdings (JKH) states that Melstacorp PLC is a 9.8% shareholder in the company as of March 31, 2019.

buy albuterol online buy albuterol online no prescription

Jayawardena controlled Melstacorp is now the third largest shareholder in the company. Jayawardena chairs the board of Melstacorp, while its managing director is former long time Commercial Bank (COMB) CEO Amitha Gooneratne.

JKH's largest shareholder is Sohli Captain with 11.6%. He has been the largest shareholder for many years, and with other connected parties controls over 20% of the total shares in the company.

The Malaysian sovereign fund the second largest shareholder holding 10.

8%. Although they have not added to their holdings recently, the percentage of total outstanding shares that they own has increased due to a stock buyback done by the company.

Concentrated shareholding

The three largest shareholders and connected parties in total control roughly 40% of the total outstanding shares and 40% of the corresponding proxy votes that come with them. Policy makers have yet to weigh in on the favourability of such an important company being dominated by a large controlling shareholder.

Legislation has been passed to limit concentrated shareholdings in Sri Lanka's largest banks, and rules are currently being mooted to limit controlling shareholdings in Sri Lanka's deposit taking finance companies.

Valuation seems attractive

Shares of JKH finished the week at Rs138/share. The company currently has a market cap of just over US$1bn. The stock trades at a PE of 12 times trailing earnings. Book value is Rs155/share. JKH stock appears inexpensive, but the devastating Easter Sunday terror attacks in Sri Lanka are sure to have a negative impact on corporate results in the coming quarter.

A new buyer emerges

According to several analysts, with Sri Lanka's largest pension fund the EPF now coming back to the stock market, it is likely that they will begin a steady accumulation of shares in JKH. This is likely to put a floor under the stock price in the near term.

The EPF used to own close to 10% of the total shares of the company. This shareholding was sold to the Malaysian sovereign fund in 2012.