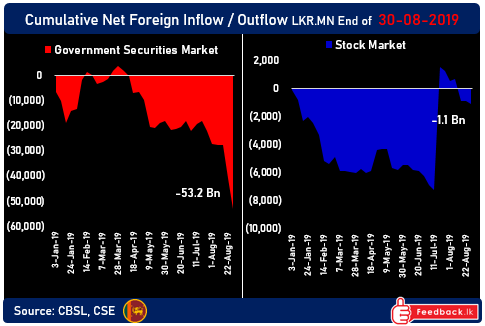

September 2, 2019 (LBO) - Why have Sri Lanka's government bonds become so unattractive? Foreign institutional appetite for Sri Lanka's rupee denominated government securities has all but disappeared after years of robust demand.

In just the last two weeks US$140mn has left the government bond markets leaving total foreign holdings of just Rs111bn (US$610mn). Sri Lanka's rupee denominated government securities, with their relatively high yields, at one time attracted several billion dollars from overseas investors. The inflows were at one point so high that the CBSL had to impose restrictions on foreign holdings of government securities. The restrictions were in response to fears of the fallout that may have resulted from a quick exodus of such a large amount of capital.

The past large inflows into Sri Lanka's bond markets kept the currency relatively strong, and demonstrated that Sri Lanka was very much an 'investable' country for global investors.

buy clomid online buy clomid online no prescription

As the total foreign holdings dwindle to such small numbers in the global context, it is debatable whether global investors will come back in the near future. Policy makers would be wise to take note of this and focus attention on the attractiveness of Sri Lanka's capital markets before the damage becomes irreparable.

The outflows from Sri Lanka's bond markets could be a confluence of many factors, some being: global exodus from emerging markets, global trade wars, local political instability, reductions in interest rates by the Central Bank of Sri Lanka (CBSL), failure of policy makers to market Sri Lanka as an attractive investment destination.

Whatever the reasons may be, the trend is troubling. Although it is admirable that the CBSL has been able to manage these large outflows without any major disruption, it is important that they recognise that there is an issue that needs to be dealt with. They must understand why and possibly respond to the fact that global investors no longer want our bonds.