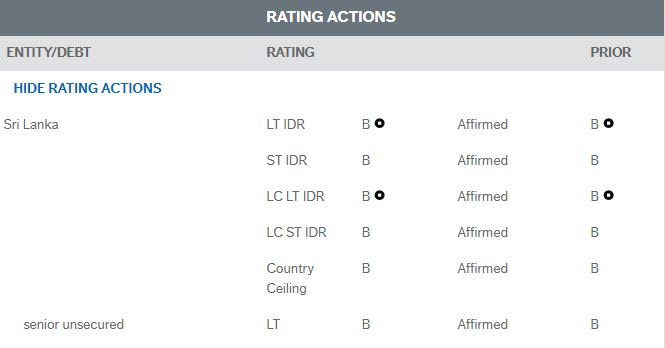

Sep 27, 2019 (LBO) – Fitch Ratings has affirmed Sri Lanka's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'B' with a Stable Outlook.

KEY RATING DRIVERS

Sri Lanka's 'B' rating balances high government debt and contingent liabilities, a challenging external financing profile and subdued economic growth against higher human development standards and per capita income levels compared with peer medians.

The policy environment has improved after the resolution of last year's political standoff. The 2019 budget was passed and the IMF programme resumed and was extended by one year to June 2020. The IMF staff announced recently an agreement on the sixth review of the extended fund facility (EFF). The currency appreciated by about 3% against the US dollar by end-1H19 after weakening by nearly 19% by end-2018. However, Sri Lanka is entering an election cycle, with presidential elections in November this year followed by parliamentary elections in 2020, and the risk of policy slippage and political tensions resurfacing closer to the elections remains high, in Fitch's view.

Fitch forecasts a budget deficit of 5.4% of GDP in 2019, above the authorities' target of 4.4%, as weak growth partly reflecting the drop in tourists has adversely affected revenue collection. We expect the deficit to stabilise at about 5% of GDP in 2020 and 2021 under our baseline assumptions. Downside risks to our projections could arise from a shift towards a more expansionary fiscal policy.

Fitch has revised its growth forecast for 2019 to 2.8% from 3.6% at the time of the previous review in December 2018 because of the negative impact of the April 2019 bombings on tourism, which accounts for about 5% of GDP. Growth slowed to 2.6% in 1H19 from 4.2% in 1H18, dragged down by a slowdown in services. However, the recovery in tourism has been faster than our expectations and we anticipate an improvement in growth in 2020 and 2021 to 3.3% and 3.4%, respectively. Tourist arrivals in August fell about 28% yoy after a decline of about 71% in May, according to the latest data from the central bank.

Sri Lanka's near-term external and fiscal financing constraints have eased somewhat after the resumption of the IMF programme in February and the issuance of USD4.4 billion of sovereign bonds to date in 2019. In addition, the sovereign has also repaid USD1.5 billion in international sovereign bonds. Foreign-exchange reserves rose to USD8.5 billion after declining to USD6.9 billion by end-2018. We project foreign-exchange reserve coverage to remain at around three months of current external payments through 2021. Nonetheless, Sri Lanka's external debt obligations (principal and interest) remain substantial over 2020-2023, with nearly USD19 billion due, and its external liquidity ratio remains far weaker than peer medians. A prolonged period of policy uncertainty accompanied by an adverse shift in investor sentiment could exacerbate Sri Lanka's external refinancing risks.

Monetary policy continues to focus on maintaining macroeconomic stability and inflation has remained subdued so far in 2019, partly a result of the slowdown in growth and lower food and commodity prices. The benign outlook for inflation combined with slowing growth led the Central Bank of Sri Lanka to cut policy rates twice this year by a cumulative 100bp. A planned amendment to the Monetary Law Act would establish price stability as the primary objective of the central bank and support the shift towards flexible inflation targeting, thereby improving monetary-policy credibility.

We expect Sri Lanka's current account deficit to narrow slightly to 3.1% of GDP in 2019 from 3.2% in 2018, as the negative impact from lower tourism earnings has been somewhat offset by a drop in imports. Taxes imposed on a wide range of automobiles led to a contraction in vehicle imports, while gold and rice imports also fell. Sri Lanka's trade deficit narrowed to USD4.3 billion in the first seven months from a deficit of USD6.4 billion a year earlier. We expect the current account deficit to narrow further to about 2.8% of GDP by end-2021 but there are risks to our forecast from a possible shift towards more expansionary fiscal and monetary policies or weaker-than-expected export performance.

High government debt and large interest payments remain a key credit weakness. Sri Lanka's gross general government debt (GGGD) was about 83% of GDP at end-2018, far greater than the current 'B' median of 56.4%. Interest payments as a share of revenues were very high at about 44% (current peer median 10.4%), highlighting the relatively weak structure of Sri Lanka's public finances. In addition, foreign-currency debt is nearly half of total government debt and leaves public finances vulnerable to renewed currency depreciation.

Fitch maintains a negative outlook on Sri Lanka's banking sector as we anticipate continued pressure on banks' financial profiles due to pressure from a challenging operating environment. The trend of rising non-performing loans (NPLs) continued into 2019, with the sector-wide NPL ratio rising to 4.8% by end-June 2019. Credit risks are likely to linger, reflected in an increase in restructured loans across banks. Rescheduled loans reflect situations where the bank takes pre-emptive action to restructure ahead of non-payment by the borrower and are not included in the headline NPL figures. Banking-sector loans contracted by 0.5% in 1H19 after a 20% increase in 2018. Asset-quality stresses have weakened earnings and added to capitalisation pressures despite the capital injections made ahead of the Basel III implementation. Capital-raising plans could face execution risks as the recent rights issues of some banks have been undersubscribed.

Sri Lanka's basic human-development indicators, including education standards, are high compared with the 'B' median. Furthermore, the country's per capita income of USD3,972 (Fitch estimates as of end-2019) is higher than its historic 'B' median of USD3,391. Sri Lanka ranks in the 60th percentile of the UN's Human Development Index compared with the 35th percentile of the current 'B' median.

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

Fitch's proprietary SRM assigns Sri Lanka a score equivalent to a rating of 'B+' on the Long-Term Foreign-Currency (LT FC) IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM to arrive at the final LT FC IDR by applying its QO, relative to rated peers, as follows:

- External Finances: -1 notch to reflect high refinancing needs against relatively low foreign-currency reserves, which leave the external position vulnerable to any adverse shifts in investor sentiment.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

RATING SENSITIVITIES

The main factors that individually, or collectively, could trigger a positive rating action are:

- Improvement in external finances supported by lower net external debt or a reduction in refinancing risks, for example from a lengthening of debt maturities.

- Improved macroeconomic policy coherence and credibility.

- Stronger public finances underpinned by a credible medium-term fiscal strategy that places GGGD/GDP on a downward path.

The main factors that, individually or collectively, could trigger negative rating action are:

- Increase in external funding stresses accompanied by a loss of investor confidence that threatens the ability to repay external debt.

- A deterioration in policy coherence and credibility, leading to lower GDP growth and/or macroeconomic instability.

- An increase in GGGD/GDP, potentially reflecting wider budget deficits and/or a crystallisation of contingent liabilities - linked to state-owned entities or government-guaranteed debt - on the sovereign balance sheet.

KEY ASSUMPTIONS

- Global economic outcomes are consistent with Fitch's latest Global Economic Outlook.

ESG CONSIDERATIONS

- Sri Lanka has an ESG relevance score of '5' for political stability and rights as World Bank governance indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight.

- Sri Lanka has an ESG relevance score of '5' for rule of law, institutional and regulatory quality and control of corruption as World Bank governance indicators have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight.

- Sri Lanka has an ESG relevance score of '4' for human rights and political freedom as World

Bank governance indicators have the highest weight in Fitch's SRM and are relevant to the rating and a rating driver.

- Sri Lanka has an ESG relevance score of '4' for creditors' rights as willingness to service and

repay debt is relevant to the rating and a rating driver.