The Monetary Board of the Central Bank has decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 14.50 percent and 15.50 percent, respectively.

The Board, having noted the recent and expected developments and projections on the domestic and global macroeconomic fronts, is of the view that the maintenance of the prevailing tight monetary policy stance is imperative to ensure that monetary conditions remain sufficiently tight to rein in inflationary pressures.

Such tight monetary conditions, together with the tight fiscal policy, are expected to adjust inflation expectations downward, enabling the Central Bank to bring inflation rates towards the desired levels by end 2023, thereby restoring economic and price stability over the medium term.

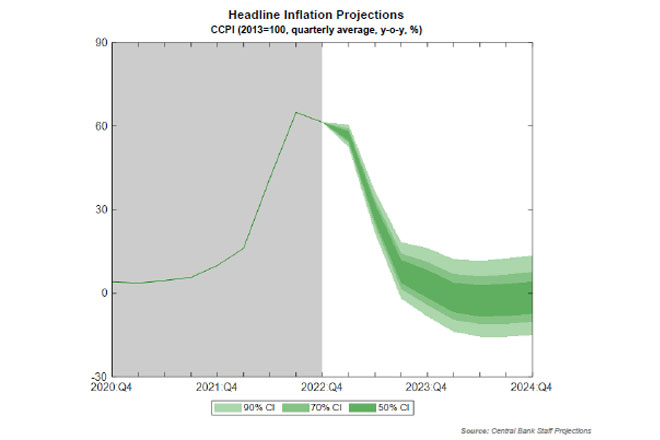

Year-on-year headline and core inflation, based on both the Colombo Consumer Price Index (CCPI) and the National Consumer Price Index (NCPI), continued to decelerate in December 2022 for the third consecutive month, as expected.

The downward adjustment in inflation rates is expected to continue through 2023, supported by subdued aggregate demand resulting from tight monetary and fiscal policies, expected improvements in domestic supply conditions, and the passthrough of easing global commodity prices to domestic prices, along with the favourable statistical base effect.

Early signs of a gradual easing of excessive market interest rates have been observed recently in response to the administrative measures adopted by the Central Bank, along with the improvements in domestic money market liquidity and overall sentiments in the domestic markets.

Recent measures adopted by the Central Bank to reduce the overreliance of licensed commercial banks on the standing facilities of the Central Bank and the concurrent conduct of open market operations helped improve liquidity in the domestic money market.

This prompted activity in the interbank money market.

Improved liquidity conditions, along with improved investor sentiment on the anticipation of “financing assurances” from official creditors, led to a notable moderation in the yields on government securities recently, reflecting the easing of the high risk premia attached to government securities.

Meanwhile, the market deposit rates have also shown a notable moderation, benefiting from improved liquidity conditions. These developments are expected to pave the way for an easing of excessive market interest rates in the period ahead.

Nevertheless, outstanding credit extended to the private sector by commercial banks continued to contract in response to the tight monetary conditions and the moderation in economic activity. Monetary expansion also moderated from peak levels, albeit at a slower pace.

Understanding-the-Inflation-Fan-Chart-of-the-Central-Bank-of-Sri-Lanka-3