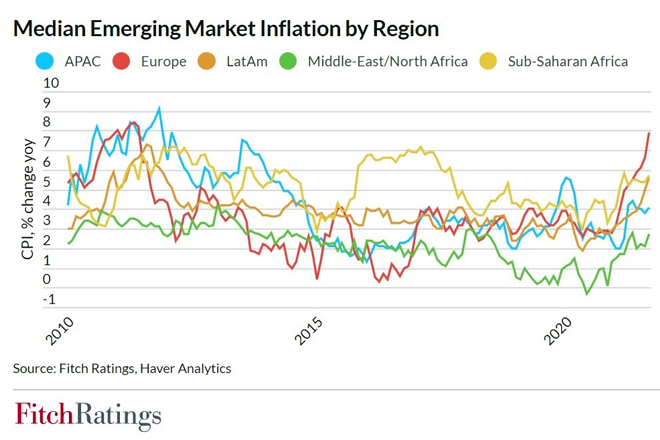

Higher inflation is generally credit negative for sovereigns, but presents particular risks for emerging markets (EMs), as they often face higher and more volatile inflation than developed markets (DMs), and are exposed to greater currency instability, says Fitch Ratings.

Fitch believes global goods price pressures will ease from early 2022, but inflation could remain elevated in many markets if services prices pick up. Inflating away debt does not constitute a default, but defaults are correlated with high rates of inflation.

Higher inflation is a negative factor in Fitch’s Sovereign Rating Model, reflecting the risk of economic overheating, as well as growing macroeconomic imbalances in labour or asset markets or in the external accounts. It may also raise concerns about macro policy credibility, especially in EMs.

The impact of higher inflation for public finances can vary. Both revenue and spending will be affected and may be subject to policy responses. However, EMs that are less able to issue debt in their own currency may be vulnerable to inflation-driven depreciation that raises the burden associated with their foreign-currency debt. Monetary policy can also be impeded by high levels of dollarisation.

The capacity to anchor medium-term inflation expectations when faced with an inflation shock varies across EMs, but is generally weaker than in DMs. In sovereigns with poor central bank transparency, patchy records of complying with inflation targets, or monetary authorities that are perceived by investors to lack sufficient policy credibility, inflation shocks may take longer to dissipate.

High inflation can have more disruptive political effects for EMs than in DMs, which can weigh on sovereign ratings. However, fiscal moves to shelter populations from the impact of inflation may also hurt public finances.