Nov 05, 2019 (LBO) – Sri Lanka's economy remains vulnerable to adverse shocks given the high public debt and low reserves, the International Monetary Fund (IMF) stressed.

Releasing the country report following the sixth review of the country's EFF, the IMF said the risks have intensified in the aftermath of the Easter Sunday attacks, amid high external and domestic uncertainty.

"A tightening in global financial conditions could trigger capital flow pressures, while trade tensions and weaker-than-expected global growth could lower exports, tourism, and growth," the report said.

"On the domestic front, the recovery of the tourism sector could take longer than projected, further weighing on credit quality and bank profitability, while protracted political uncertainty could impact program implementation and affect investor sentiment."

The Sri Lankan economy also remains vulnerable to natural disasters and on the upside, lower energy prices would reduce the current account deficit and support the implementation of energy pricing reforms.

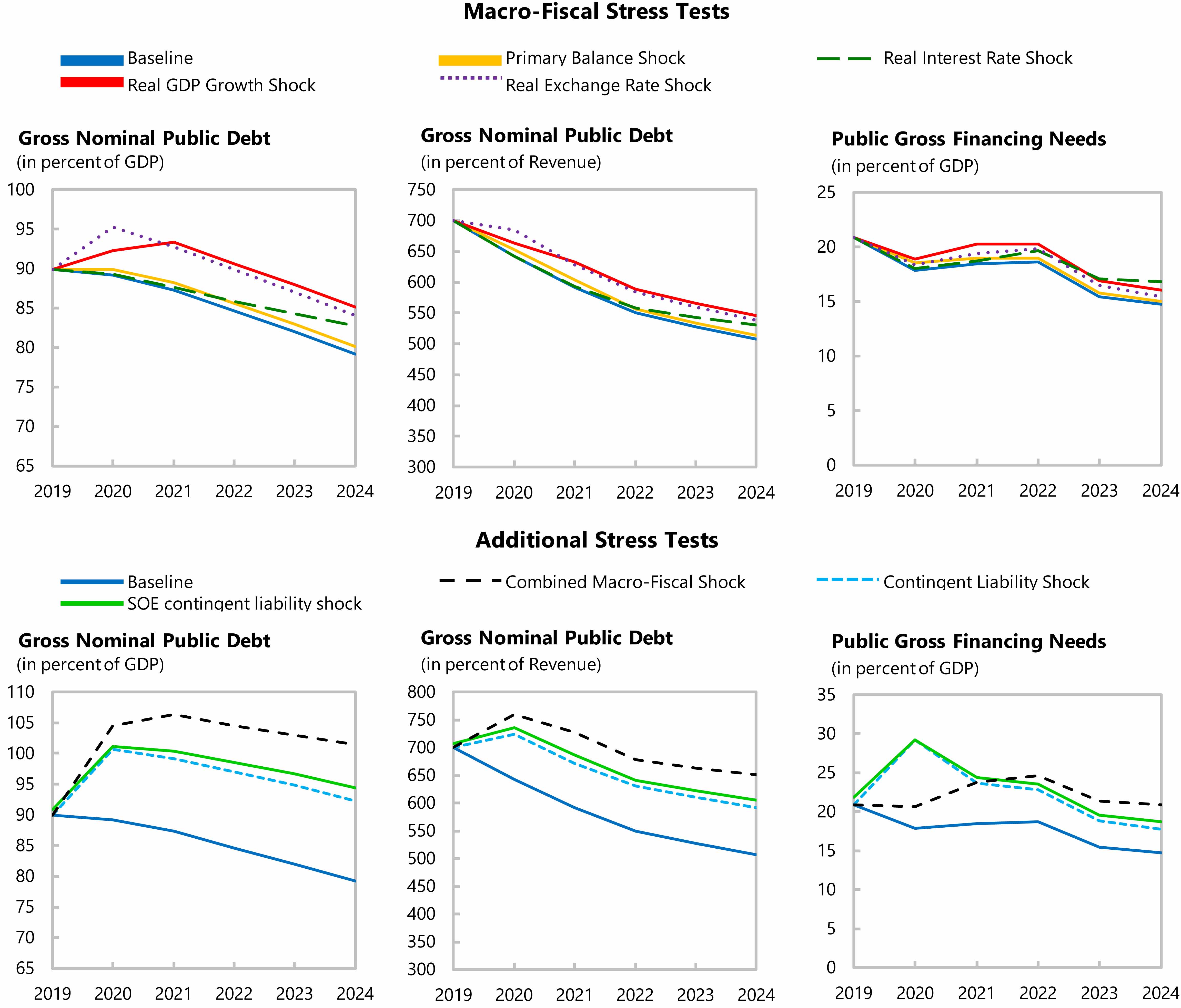

Meanwhile, the country's public debt is projected to remain broadly unchanged at 90 percent of GDP in 2019, amid a weak macro and fiscal outlook.

External repayments for 2019 were fully financed with international bond issuances in March (US$2.4 billion) and June (US$2 billion) and the authorities have started to pre-finance the 2020 borrowing needs under the Active Liability Management Act.

The next international bond redemption (US$1 billion) is not due until October 2020. A multi-year plan to establish an independent debt management agency, with IMF TA, was approved by the country's cabinet in October.

buy amoxicillin online buy amoxicillin online no prescription