July 05, 2019 (LBO) – Despite the Easter Sunday attacks Sri Lanka’s economic outlook has shown signs of resilience and ability to recover quickly as economic activities were seen returning to normalcy while removal of travel advisories was faster than anticipated, First Capital said in their latest equity strategy.

The research firm believes that the impact of the unfortunate attacks and the subsequent events has now been factored into the market and an accelerated recovery is more likely than not.

Sovereign Bond issuance supports lower yields

First Capital noted that the successful and early issuance of the 2 billion dollars sovereign bond by the CBSL is a major confidence booster and the heavy interest which was reflected by the 3x oversubscription is encouraging.

"With most economic indicators such as inflation, credit growth and liquidity suggests a decline in yields, strong reserve position supports the sustainability of the lower yields," the firm said.

"In line with expectations Bank 1 Year FD ceiling has fallen to 9.83% as of 1 st Jul 2019."

Market Earnings to improve from 4Q2019 onwards

The heavy decline in interest rates is expected to lower finance costs, thereby improving earnings of most listed entities towards 4Q2019.

Lower Fixed Income returns may lead investors to hunt for alternative investment options with higher returns, of which equity investments is likely to be a more probable option considering the current attractive valuations.

"Thereby we expect an improvement in demand for stocks leading to a possible re-rating of the market," the firm said.

buy silvitra online buy silvitra online no prescription

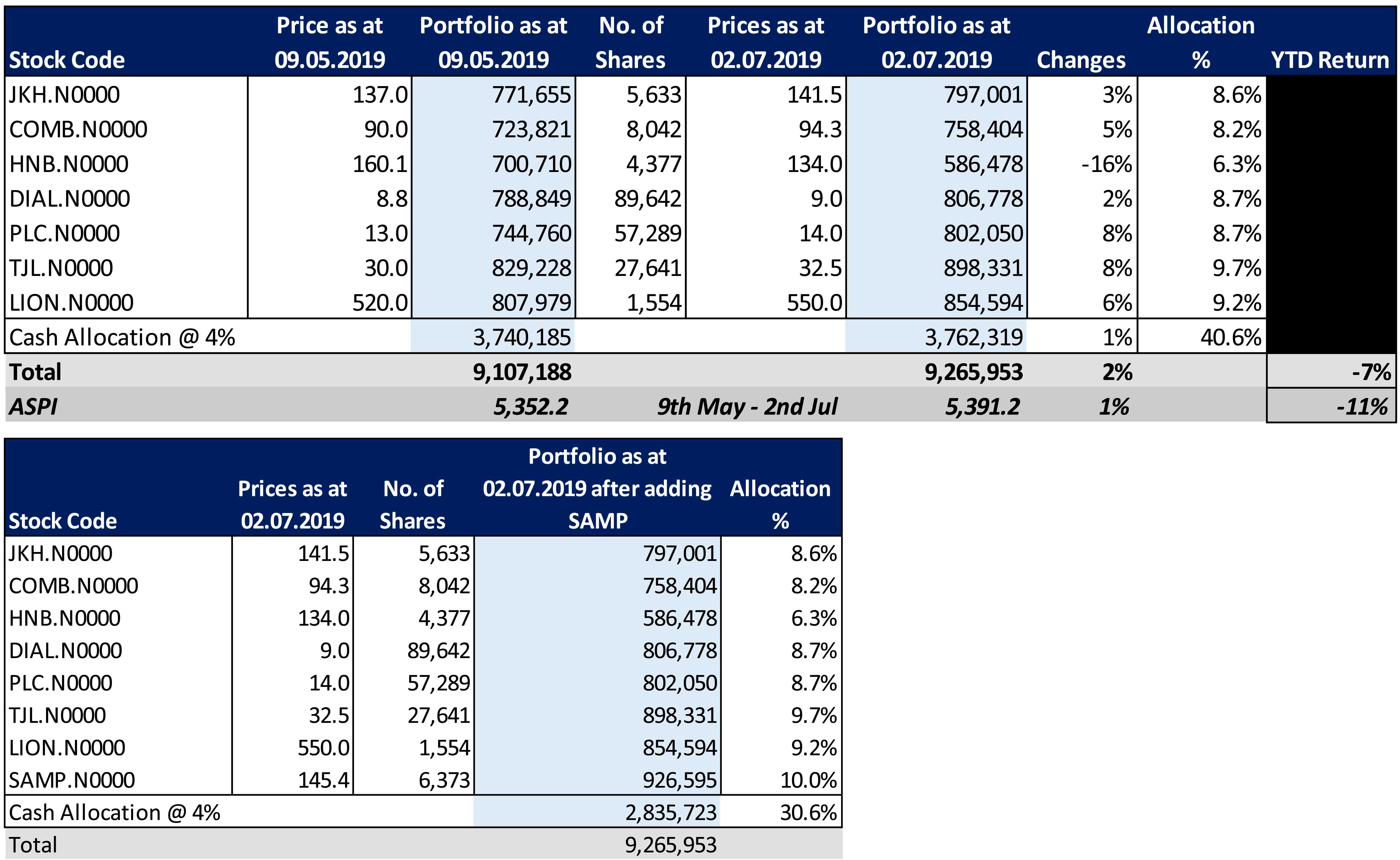

Increase equity portfolio by investing 25% of the balance cash into SAMP

First Capital said with the rights issue being fully subscribed, SAMP is correctly cash heavy with the ability to maintain lending growth well above the industry while capturing market share.

"We are bullish on SAMP and recommend investors to invest 25% of the balance cash allocation into SAMP increasing equity portion of the portfolio to 69%.

"