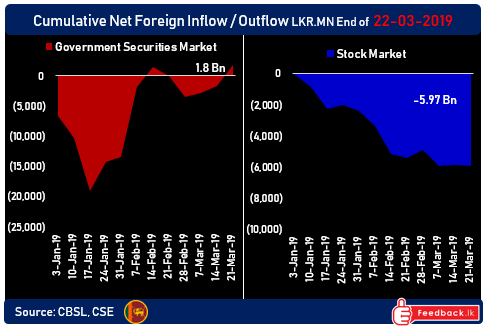

Foreign investors have increased their #SriLanka government bond holding by LKR 3.5Bn ($10.2Mn) from last week to this week. This has resulted, year to date (YTD) net foreign holdings to become positive once again. #SriLanka budget 2019 has estimated LKR 180Bn net inflow. pic.twitter.com/Sg6ZYGVSqc

— Sanjeewa Dayarathne (@DayarathneSa) March 22, 2019

Foreign flows in/out of Sri Lanka’s capital markets stabilising

March 23, 2019 (LBO) - Foreign flows into and out of Sri Lanka's capital markets appear to be stabilising after a period of significant outflows. The stabilisation of flows has also resulted in stabilisation of Sri Lanka's currency (LKR).

The LKR has been trading close to Rs178/US$ for the last few weeks, up from an all time low of Rs183/US$.

Sri Lanka experienced US$1bn worth of outflows from its capital markets in 2018. Although the start of 2019 saw a continuation if that disturbing trend, after the resolution of the country's 52 day constitutional crisis flows seem to have moderated.

In Finance Minister Mangala Samaraweera's remarks on the budget, he said that he expected inflows of approximately US$1bn into Sri Lanka's government securities market in 2019. After a successful US$2.4bn sovereign bond offering, analysts said that Samaraweera's forecasts may turn out to be accurate. If his remarks prove to be accurate, Sri Lanka's currency should continue its recent trend of appreciation.

The U.S. Federal reserve shifted policy at its meeting this week to a much more dovish stance. The forecast is for no additional interest rate hikes in 2019, which sent U.S. government 10 year bond interest rates plummeting. Emerging market flows are expected to benefit from the change in fed policy.

To date in 2019, the government bond market has seen US$10m worth of net inflow, while the equity markets have seen close to US$33mn worth of net outflows. Market watchers will be watching these statistics closely in the coming weeks to see if there is a change in trend to to U.S. Federal Reserve policy.