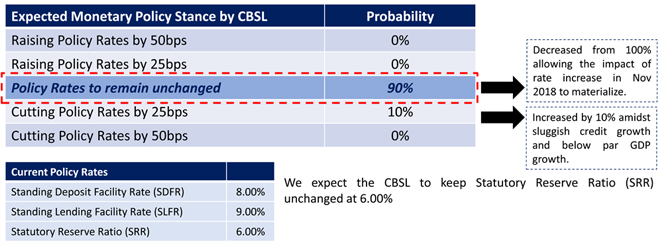

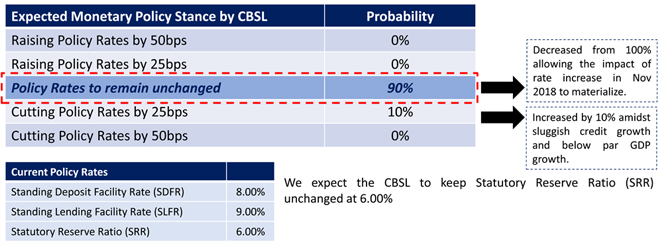

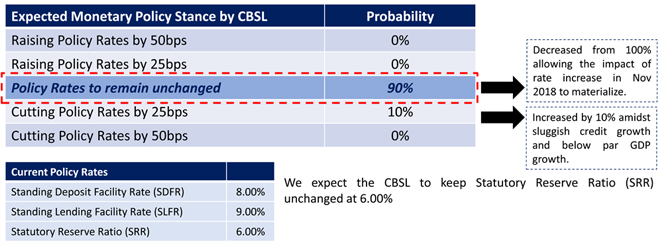

First Capital Research expects a continuation of policy rates at current levels

Feb 21, 2019 (LBO) – First Capital Research said it expects a continuation of monetary policy rates at current levels although they recognize an increased probability of 10 percent for a rate cut considering the prevailing below par GDP growth and sluggish credit growth.

First Capital Research expects the Central Bank to keep Statutory Reserve Ratio (SRR) unchanged at 6.00 percent amidst slow economic activities and to allow the impact of a previous rate hike to materialise.

The Monetary Board of the Central Bank will announce the monetary policy review No.1 of 2019, tomorrow at 7.30 a.m.

On a base case, First Capital Research expects 2 rate cuts of 25bps each during 2019 (2Q & 4Q) as overnight Central Bank standing lending facility rate which stands at 9.0 percent, they believe is too high for accelerated economic activity.

In early January the secondary market yield curve experienced a parallel downward shift predominantly on the belly and long end of the curve followed by a brief uptrend with the overall curve dipping by 22-60bps.

“Equity market saw a continuous downward shift with low activities and foreign outflow of LKR 5.1Bn YTD. However, the debt market saw an inflow of LKR 20.5Bn since mid-Jan 2019,” First Capital Research said.

“On the back of foreign inflows and accelerated USD conversions by exporters, USD: LKR strengthened towards the early Feb 2019, to reach LKR 176.65 on 01 Feb from 2018 closing of 182.90 and stabilising around 178.00-179.00 levels,”

“CBSL holdings increased throughout the period to peak at LKR 177.2Bn and stabilized around LKR 176.3Bn while market liquidity shortage widened to LKR 139.3Bn towards mid-Jan 2019 and narrowed to fall below LKR 70.0Bn.”

The firm observed that the instability in political front continued as further delay in holding provincial council elections, major political parties not having nominated their prospective Presidential candidate while divergence between the President and the UNF continue to persist.

Meanwhile, the Fed indicated the adoption of a cautious approach signaling that the tightening phase might be coming to an end amid rising risks to economic growth.

Fed Reserve officials decided to keep rates unchanged at the first meeting for 2019 as Policymakers is of the view that they have the capacity to wait and carefully take stock of the incoming data and other developments.