online pharmacy buy diflucan with best prices today in the USA

online pharmacy buy elavil with best prices today in the USA

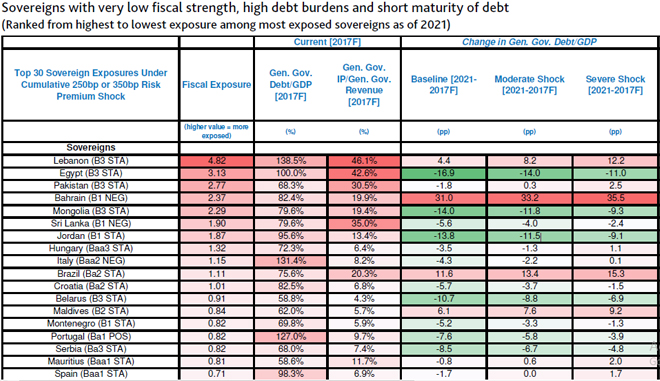

"The sovereigns most vulnerable to an interest rate shock are generally low rated, with shorter maturities and weak debt affordability," said Elisa Parisi-Capone, a Moody's Vice President.

online pharmacy buy ciprodex with best prices today in the USA

"In our view, exposure to a shift in financing conditions is highest for Lebanon, Egypt, Pakistan, Bahrain and Mongolia.

buy fildena online https://bccrf.org/minuet/wp-content/uploads/2020/08/png/fildena.html no prescription pharmacy

Sri Lanka (B1 negative) and Jordan are also highly exposed.

buy lexapro online https://bccrf.org/minuet/wp-content/uploads/2020/08/png/lexapro.html no prescription pharmacy

" For five of the 10 most exposed sovereigns Lebanon, Pakistan, Mongolia, Sri Lanka and Bahrain, Moody’s assessment of fiscal strength is “Very Low (-),” the weakest on the 15-rung scale in our global sovereign rating methodology. “While weak fiscal strength is already a key feature of these countries' credit profiles, a deterioration in fiscal metrics that would further exacerbate liquidity and external risks could weaken credit quality in either of the two potential shocks that we study,” Moody’s said.

buy chloroquine online https://qpharmacorp.com/wp-content/uploads/2023/08/png/chloroquine.html no prescription pharmacy

“Under a higher cost of debt, there would be pronounced shifts in debt affordability (interest to revenue) and burdens (debt to GDP) for these sovereigns.

buy abilify online https://qpharmacorp.com/wp-content/uploads/2023/08/png/abilify.html no prescription pharmacy

buy tamiflu online https://bccrf.org/minuet/wp-content/uploads/2020/08/png/tamiflu.html no prescription pharmacy

” Moody’s said a shock to funding costs feeds through to debt affordability relatively quickly and pressure on capital flows and the exchange rate would erode foreign exchange reserves and exacerbate external vulnerability. This is particularly relevant for Lebanon, Pakistan, Bahrain and Jordan and Sri Lanka although the latter is moving toward a more flexible exchange rate, Moody’s further said.

online pharmacy buy abilify with best prices today in the USA

buy ivermectin online https://qpharmacorp.com/wp-content/uploads/2023/08/png/ivermectin.html no prescription pharmacy

Loading...