Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — )

Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — ) Opinion: Sri Lankan Airlines, to sour or to soar?

By J. Lorenz

May 16, 2016 (LBO)- During the 2005 -2015 period Sri Lanka’s privatisation programme came to a halt, and there was a wave of expansion in state businesses. State owned enterprises grew from 107 SOEs in 2009 to 245 SOEs in 2014. At the same time the number employed grew from 140,500 to 261,683. Of these 245 SOEs, by admission of the Department of Public Enterprises, only 55 are considered strategically important and fall under their purview.

As stated by Finance Minister Ravi Karunanyake last year, the government planned to restructure these 55 strategically important SOE’s but did not discuss the balance 190 SOE’s that are seemingly unimportant but still exist.

As per the 2014 performance report these 55 entities got budgetary support of 126 billion rupees and treasury guarantees of 471.2 billion rupees.

During 2006 – 2015, some of the 55 strategically important SOE’s had a cumulative loss of 636 billion rupees with the largest loss makers being CPC 244 billion rupees, CEB 172 billion rupees, Sri Lankan Airlines & Mihin Air Ltd collectively 128 billion rupees, SLTB 61 billion rupees.

Some of the 55 SOEs had a cumulative profit of 530 billion rupees with the largest profit earners being Banking & Finance 294 billion rupees, Insurance 43 billion rupees, Ports 39 billion rupees, Lotteries 11 billion rupees, Healthcare 8 billion rupees, Construction 5 billion rupees, Media 4 billion rupees, Livestock 2 billion rupees, Plantations 1 billion rupees.

Sri Lankan Airlines and Mihin Air Ltd’s losses of Rs. 128 billion rupees amount to 21% of cumulative losses of the 55 SOEs.

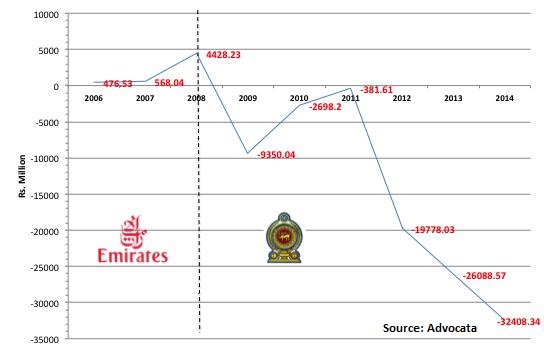

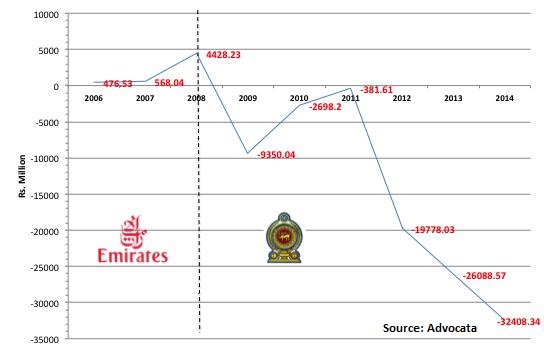

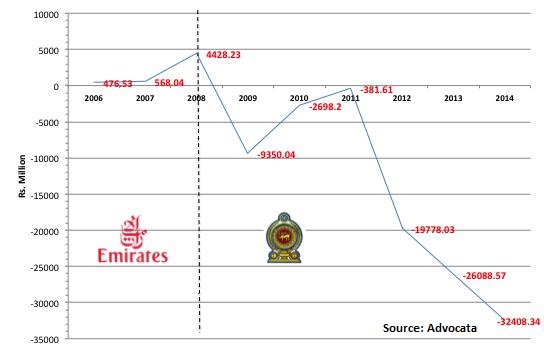

Moving backwards- from privatisation to state owned enterprises

State owned Air Lanka was privatised in April of 1998 with a 40% shareholding sold to Emirates Airlines with a management contract of 10 years. Emirates rebranded the airline as Sri Lankan Airlines and completely overhauled the operations and turned it into a profit-making venture. Although the majority ownership was retained by the GOSL since management of the airlines was taken over by Emirates they successfully re-fleeted the airline and the network was continually reappraised. During the period that Emirates Airlines managed the local airline, they succeeded in making a profit of Rs. 478.53Mn in 2006, Rs. 568.04Mn in 2007 and Rs. 4428.23Mn in 2008 when Emirates Airlines refused to recommit to a contract. In December of 2007 Chief Executive Peter Hill’s work permit was revoked due to a spat with the former government and since then the airline has made continuous losses.

Sri Lankan Airlines’ performance went from a bumper profit of 4.4 billion rupees in 2008 to accumulated losses of 123.26 billion rupees rupees in March of 2015. What is truly remarkable is the significant drop from 4.4 billion rupees profit in 2008 to 9.3 billion rupees loss in 2009, which then continued its dismal performance to a whopping 32.4billion rupees loss by 2014. The government bought out Emirates Airlines for US$ 53Mn (2008) which is about Rs. 7billion rupees as at current exchange rates, the airline lost more than 4 times its purchase price in 2014.

Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — )

Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — )

Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — )

Too sour? Justification of losses

Although the government inherited a profitable business in 2008 they successfully managed to run it into the ground due to mismanagement and corruption. The two explanations available are the Jensen and Meckling(1976) theory of ‘principal-agent problem’ and the free-rider problem, both of which concern self-seeking individuals, as discussed at the launch of Advocata Institute at the Lakshman Kadirgamar Institute earlier this month.

Managers of state owned firms are aware that salaries would be paid regardless of performance of the company hence motivation to perform is taken away thereby embodying the free-rider problem. Further, tax-payers would continue to pump money into failing SOEs whereas a private company would pump their own money into the business risking everything, hence increasing the commitment to perform well. The budget funds given to SOEs in 2014 is equivalent to every household paying 24100 rupees to keep SOEs afloat. This is while around 40% of Sri Lanka’s households earn less than 24000 rupees a month.

Continuous descent, inability to settle debt

As recent as March 2016, Sri Lankan Airlines announced its inability to settle debt of US$1billion raised as an International Bond as confirmed by PM Ranil Wickramasinghe. It is not surprising that they can’t make payments considering their dismal performance since their bumper profit in 2008. The government of Sri Lanka has taken on this debt in addition to the mounting debt already in place which continues to rise. Further the number employed by Sri Lankan Airlines since it was taken over by the GOSL has increased from 5317 employees as of 2008/09 to 7870 employees as of 2014/15, i.e. an average increase of 6.5% each year, adding pressure to an already severe loss situation.

Informing the public of the national carrier’s inability to settle debt, Wickramasinghe also went on to state that 4 of the 8 Airbus A350’s ordered have been cancelled. As per the 2014/15 annual report of Sri Lankan Airlines, the balance 4 A350-900 aircraft lease commitment was entered into on a ‘non-cancellable’ operating lease totaling to Rs. 92.1Bn. Total ‘non-cancellable’ operating lease commitments are a whopping Rs. 199.5Bn as at 31st March 2015 in respect of four A330-300, four A350-900 and four 321NEO Aircrafts.

Time to soar?

With the finance ministry stating that the airline will be kept afloat only till October 2016, the question remains, what would happen to the national carrier?

Is there any possibility of a turn around?

Privatisation seems to be the answer although many talk of following the Temasek model of Singapore (state holding company), due to the success of Singapore Airlines. While Singapore Airlines is an exceptional success, a comparison cannot be drawn between the two national carriers, nor the economies of the two countries. The Temasek model may have worked well for Singapore, but it’s doubtful it could work just as well for Sri Lanka.

It is difficult to replicate in Sri Lanka what has been done in Singapore . In a country where it is seemingly impossible to de-politicise running of SOEs and subject them to competition from domestic and international players, hoping for Singapore Airlines’ strategy to be applicable to Sri Lankan Airlines seems futile.

Hence the only way forward seems to be via privatisation, which has proved to be a success in the past.

( — J. Lorenz is an independent writer, researcher based in Colombo, with interests in macro-economic issues — )